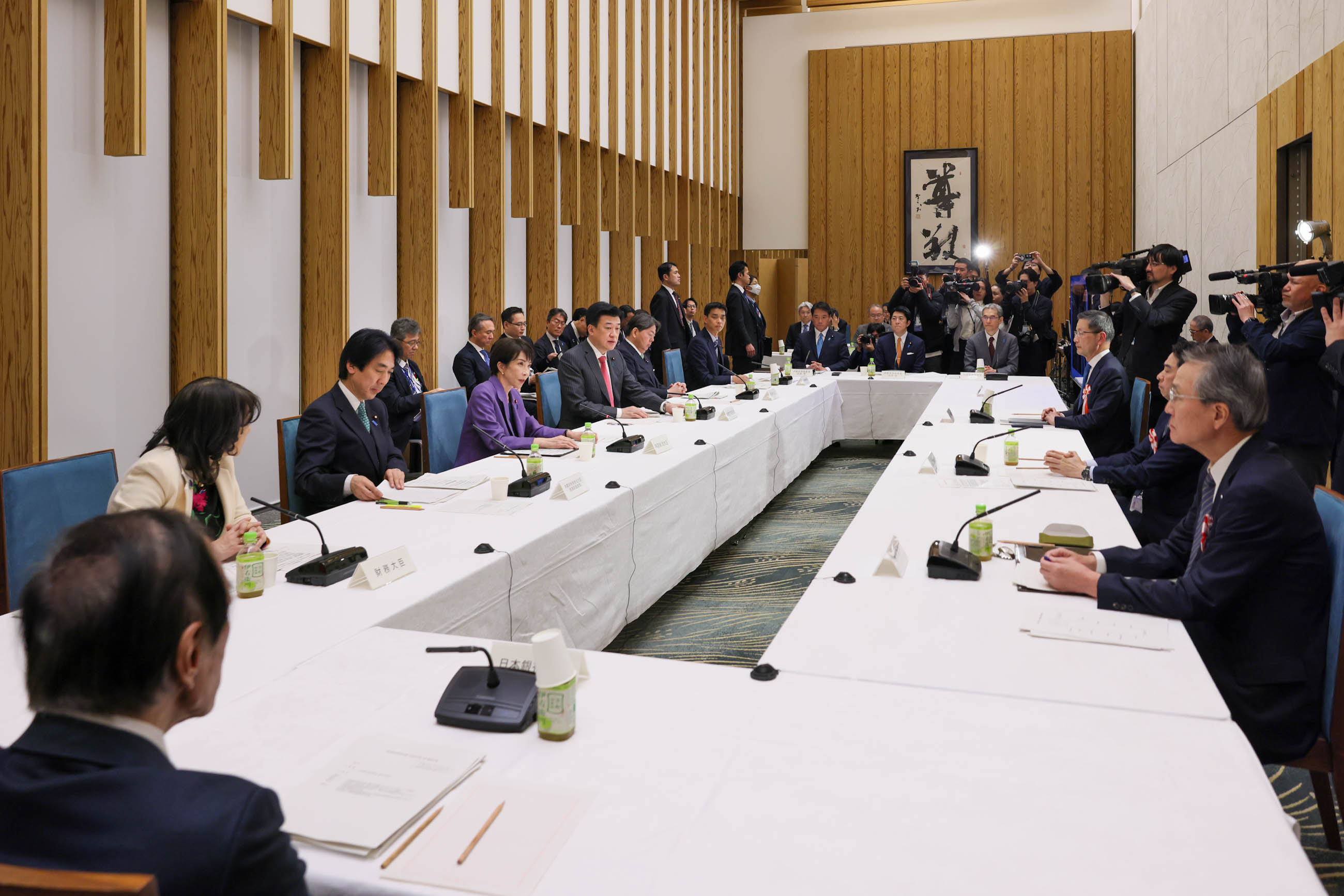

Meeting of the Council on Economic and Fiscal Policy

January 22, 2026

[Provisional translation]

On January 22, 2026, Prime Minister Takaichi held the first meeting of the Council on Economic and Fiscal Policy in 2026 at the Prime Minister's Office.

At the meeting, the participants engaged in discussions on medium- to long-term economic and fiscal projections.

The Prime Minister stated as follows based on the discussions:

“Today, we held discussions based on the Economic and Fiscal Projections for Medium to Long Term Analysis presented by the Cabinet Office.

Since the inauguration of the Cabinet, under the concept of ‘responsible and proactive public finances,’ we have been working toward the realization of a strong economy, including bold investments in areas where investment is necessary, such as strategic investments that enhance resilience against potential crises and investments that promote growth, while also prioritizing key policy areas within the budgets.

As a result,

• In the FY2025 supplementary budget, we have kept the amount of government bond issuance after the supplementary budget below that of the previous fiscal year, and

• In the FY2026 budget, within the national general account, we have kept the amount of newly issued government bonds below 30 trillion yen for the second consecutive year and lowered the dependence on government bonds; in addition, we achieved a primary surplus for the first time in 28 years.

In this way, we have conducted economic and fiscal management with sufficient consideration given to fiscal sustainability.

As an outcome of the economic and fiscal policy management based on these ideas, the latest Economic and Fiscal Projections for Medium to Long Term Analysis show that the public finances of the central and local governments will steadily improve in the scenario where the transition to a growth-oriented economy is realized. To be specific:

• the ratio of outstanding debt to GDP is projected to decline steadily from the current fiscal year into the next fiscal year and beyond.

• the primary balance of the central and local governments on an SNA basis will continue improving, with the primary balance in FY2026 becoming the smallest deficit since FY2001, when the government adopted the primary balance target, and being broadly balanced. Thereafter, the primary balance is projected to be a certain surplus margin.

These projections indicate that the fiscal situation is improving steadily.

From the experts, we received proposals such as:

• For the Basic Policy, further clarifying the direction of restraining the growth of government debt within the range of nominal economic growth and, thereby, steadily reducing the debt ratio;

• Accelerating strategic investments that enhance resilience against potential crises as well as investments that promote growth to raise potential growth and ensure that the reduction in the debt ratio does not remain temporary but becomes part of a stable growth path;

• Recognizing that, in a phase of rising interest rates, it is also important to keep a careful watch on interest payments for the purpose of maintaining credibility;

• When setting future fiscal management targets, confirming the various indicators shown in these Economic and Fiscal Projections for Medium to Long Term Analysis.

Although fiscal conditions are expected to continue improving steadily, the debt-to-GDP ratio remains at a high level. Therefore, we will continue to carry out economic and fiscal management based on the concept of ‘responsible and proactive public finances,’ pursue integrated economic and fiscal reforms throughout the duration of the ‘Economic and Fiscal Plan for New Stage,’ and lower Japan's ratio of outstanding government debt to GDP. This will bring about the sustainability of public finances and ensure that we gain trust from the markets.

To achieve this, it is important to make sure to restrain the growth of government debt within the range of nominal economic growth and, thereby, steadily reduce the debt ratio by raising the growth rate without reversing the progress or achievement of initiatives taken so far and by keeping an eye on rising interest rates.

Based on this approach, going forward, we are considering changing the policy of checking the achievement of the primary surplus target in each single-fiscal year into one of checking its balance over multiple years. In doing so, I ask Minister Kiuchi to lead the relevant ministers, while taking into account discussions within the ruling parties, in order to advance examinations toward this year’s Basic Policy. I also ask the experts to continue providing active discussion.”