Nikkei Sustainable Forum

[Provisional translation]

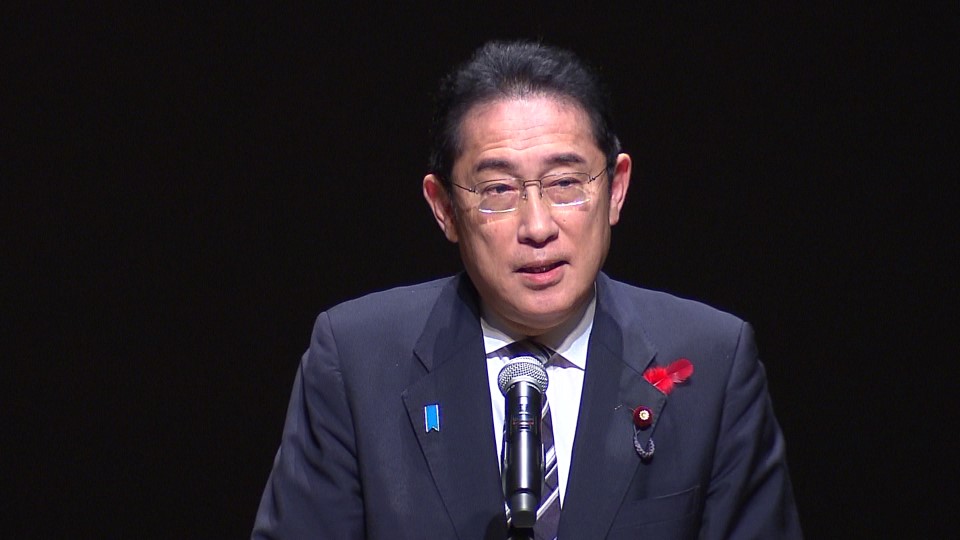

On October 2, 2023, Prime Minister Kishida attended the Nikkei Sustainable Forum held in Kyoto.

Prime Minister Kishida delivered the following opening remarks at the “Global Institutional Investor Trends” session:

“Thank you very much for inviting me to the Nikkei Sustainable Forum today. I would like to congratulate on the success of this forum and offer a few words on the occasion of its opening.

I am advocating the "New Form of Capitalism," in which the public and private sectors work together and transform social challenges into engines of growth. One of the key policy agenda is to promote a fundamental shift from savings to investment, whereby household funds are channeled into investment for growth to achieve household asset formation and sustainable development for Japan and the world.

First, in order to broaden the movement from savings to investment among a wide range of people, we will drastically expand NISA, the tax exemption scheme for small investments, and make it permanent, while enhancing financial and economic education.

At the same time, it is important to reform the asset management sector, which manages investments of household financial assets.

I want to realize the asset management sector where excellent domestic and overseas firms and human resources will gather in Japan, compete with each other to enhance their expertise and asset management capabilities, and provide better products and services to investors, including households.

To achieve this, we will rectify Japan’s unique business practices and resolve barriers to entry, introduce a new program to assist new entrants, and promote deregulation to enable asset management firms to outsource back-office operations so that they can focus on asset management.

Furthermore, we will strengthen our efforts to develop Japan’s financial and capital market that is open to the world so that Japan will be chosen as a center for asset management. To this end, we will establish special business zones tailored specifically for asset management business in cooperation with aspiring local governments, where we will introduce regulatory reforms and improve business and living environment tailored to needs of overseas asset managers.

In addition, we will call for major financial groups with asset management companies to enhance their asset management capabilities and improve governance.

We will also work to reform asset ownership such as pensions and insurance which undertakes management of households’ investments. We will formulate "Asset Owner Principles," which clarifies the roles expected to asset owners so that best outcomes can be achieved for beneficiaries, by summer 2024. The Principles will call for asset managers to select asset management companies that provide the best benefits and to make investment outcomes visible to stakeholders.

In particular, with regard to corporate pension plans, in addition to enhancing the visibility of asset management for participants, we will endeavor to expand joint management options for defined-benefit plans, and enable participants of defined-contribution plans to select appropriate products.

In order to flesh out these initiatives, I will establish a subcommittee under the Council for the Realization of New form of Capitalism on October 4, where a policy plan will be developed by the end of this year. We will listen sincerely to various opinions and decisively undertake necessary reforms.

Next, I would like to touch on Japan’s attractiveness as an investment destination. In Japan, there is a strong movement to transform social challenges into engines of growth. Many companies have positioned sustainability as their core management issue, and an increasing number of young entrepreneurs are trying to solve global social challenges such as decarbonization with Japan’s technologies.

We will strongly support these developments. Specifically, we will promote investment in human capital, start-ups, advanced technologies and GX/DX (green transformation and digital transformation), in collaboration with the private sector. First, with regard to green innovation, we will issue, this fiscal year, the world’s first sovereign transition bond, which is named “Japan Climate Transition Bond”, in conformity with international standards. This will be used to fund around 20 trillion yen of upfront investment by the government to catalyze more than 150 trillion yen of decarbonization investments, public and private sectors combined, in the next ten years.

Investment in intellectual property and other intangible assets is also important to promote domestic investment. In order to encourage investment in innovation for the creation of intellectual property and its industrialization, we will consider establishing a tax incentive program for incomes from intellectual property.

Furthermore, in order to support the development of start-ups working on social challenges, we will develop impact investment, which intends to realize both solution of social challenges and investment returns, as a major investment method.

I envision Japan becoming an international financial center that attracts outstanding human resources from home and abroad and transforms social challenges into energy for growth through the power of finance. I will do my utmost to realize this vision. Thank you very much for your kind attention.”