Home > News > The Prime Minister in Action > December 2017 > Meeting of the Government and Ruling Parties

The Prime Minister in Action

Meeting of the Government and Ruling Parties

December 8, 2017

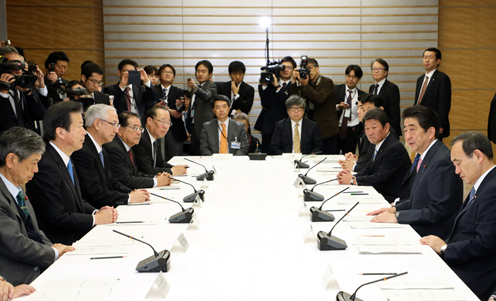

Photograph of the Prime Minister delivering an address (1)

Photograph of the Prime Minister delivering an address (2)

Photograph of the Prime Minister delivering an address (3)

[Provisional Translation]

On December 8, 2017, Prime Minister Shinzo Abe attended a Meeting of the Government and Ruling Parties at the Prime Minister's Office.

At the meeting, there was discussion on the new economic policy package.

Based on the discussion, the Prime Minister said,

“We are promoting revolutions in productivity and human resources development as two wheels of a cart in tackling the enormous challenge of a declining birthrate and aging population. To that end, a Cabinet decision will be made today to approve the new economic policy package.

To achieve a revolution in productivity, we must thoroughly ensure that the largest corporate profits in history lead to wage increases and capital investments by 2020.

For that purpose, we will lower the corporate tax burden of companies that are making active investments including wage increases by 3% or more, to the OECD average of 25%. Furthermore, for companies that challenge themselves to improve productivity by using innovative technology, we will boldly lower their corporate tax rate to 20%, thereby providing them with an environment in which it is possible to surpass their global competitors. Meanwhile, for major corporations that are reluctant to increase wages and investments despite rising profits, we are considering making them take accountability for this through corporate governance reforms, and also introducing tax measures that encourage decisive management decisions.

In addition, for those small- and medium-size enterprises (SMEs) that are taking on the challenge of making active investments, despite difficult financial conditions, including deficits, we will offer manufacturing and service subsidies through the supplementary budget, and create for the first time a system that will lower their fixed asset tax rate to 0% for three years, while also taking care to ensure the independence of local governments.

I wish to express my heartfelt gratitude for the intensive discussions held in the designated tax commissions of the ruling parties regarding these unprecedented, bold, and focused tax measures, which are befitting of our aim to achieve a revolution in productivity.

In addition, we will carry out structural reforms in line with the Society 5.0 era, including the opening of frequency bands in response to technological innovation, as well as create regulatory sandbox frameworks and submit a bill to the next ordinary session of the Diet so as to connect businesses with innovative ideas.

We will make our utmost efforts to exit deflation by leading the productivity revolution that is emerging around the world by leveraging all possible policies, including tax, budget, and regulatory reform measures, and further expanding the wage increases that we have seen for the past four consecutive years.

Meanwhile, human resources development is a challenge for the longer term. By FY2020, we will establish a foundation for new frameworks not constrained by conventional systems or practices.

First, we will rapidly accelerate the provision of early childhood education for free. We will make all kindergarten, childcare centers, and certified childcare facilities free of charge for all children between three and five years of age. Furthermore, for all children aged from birth to two years old, we will advance efforts to eliminate childcare waiting lists and make childcare free of charge for households eligible to be exempted from municipal tax under this policy package.

Second, we will bring forward the schedule for the Plan for Raising Children with Peace of Mind, which aims to achieve zero children on waiting lists for childcare facilities, and further expand the capacity of childcare facilities by 320,000 children by the end of FY2020. At the same time, we will make further efforts to secure childcare workers and improve employment conditions in light of the wage disparities that exist between the childcare industry and other industries, and we will raise wages in accordance with the National Personnel Authority (NPA) Recommendation. Furthermore, we will raise wages by an additional 1% from April 2019.

Third, we will make tuition fees at universities and other higher education institutions free for children from low-income households, who are truly in need of support. For students from the households eligible to be exempted from municipal tax, if they attend public universities we will waive their tuition and if they attend private universities we will calculate the average tuition fee for private universities and offer a fixed grant. Furthermore, we will fundamentally enhance fund-type scholarships, and implement measures to help cover necessary daily life expenses. We will also offer equivalent support to children from households that are at around the same income level as households eligible to be exempted from municipal tax, in stages, to ensure that the support they receive does not abruptly end.

Fourth, in response to the request for consideration made by Chief Representative Natsuo Yamaguchi of Komeito, we have specified that tuition at private high schools will be made effectively free for households making less than 5.9 million yen a year. To do so, we will first secure the funds made available from revisions to current systems and budgets due to the reallocation of consumption tax revenue. After the reallocation of revenue from consumption tax, by FY2020, the Government as a whole will continue to secure a stable source of funding for this initiative, including using funds obtained from current systems becoming part of regular fiscal year budgets, and ensure that tuition at private high schools will be effectively free. This will be done from the perspective of making it possible for students to receive a broad education, regardless of the economic situation of their household.

Fifth, to reduce to zero the number of people who leave employment to offer nursing care to their family members, we will further improve employment conditions for caregivers. We will invest approximately 100 billion yen in public funds to improve their conditions by October 2019 for certified care workers with 10 years or more of work experience at nursing service companies. This figure is based on a calculation that aims to offer such caregivers an improvement in benefits equivalent to 80,000 yen per month on average.

We will use the revenue created by the increase in consumption tax to 10% to ensure that we have stable financial resources. This increase in revenue will be divided roughly in half between measures to alleviate the financial burden of education, support households raising children, and secure human resources in nursing on the one hand, and fiscal rehabilitation on the other. We will utilize approximately 1.7 trillion yen in new funds for the former set of issues.

In addition, we will increase contributions to children and those raising children by 0.3 trillion yen as a part of major efforts to support the generation raising children throughout our society.

By implementing approximately 2 trillion yen’s worth of policy measures and boldly investing government resources in the generation raising children and children themselves, we will promote a great transformation in the social security system and make it one that is oriented to all generations, allowing both the elderly and the young to live with peace of mind.

I ask for the continued and full cooperation of the leadership of the ruling parties and relevant ministers toward the realization of this new economic policy package.”